“The only constant in life is change.”

– Heraclitus

Battle of the Narratives - AI Boom or Geopolitical Bust?

Hard to believe it’s only been six months.

Since taking office in January, Donald Trump’s presidency has played out more dramatically than most economists would care for. Domestically, the recently-passed “Big Beautiful Bill” has cut taxes and boosted spending (despite cuts to social programs), increasing US deficit forecasts and shaking up the country’s bond market, where yields have reached multi-decade highs. Internationally, the President has disrupted global supply chains with aggressive tariffs, first targeted at the country’s largest trade partners (Mexico, Canada, and China) and now broadly applied to most imports, with auto parts and certain metals (steel, aluminum, and as of July 8th, copper) being specifically targeted. Add in the flurry of executive orders and geopolitical escalations in the Middle East, and the first six months of 2025 have been remarkably volatile, with economists forecasting economic weakness across the globe.

It's perhaps shocking then that amid the international turmoil, markets have managed to crest new all-time highs, with valuations approaching their highest point in the US since the dot-com bubble. The optimism appears to be driven by two factors – the continued development of artificial intelligence (and the business opportunity it presents), and a sentiment that Donald Trump may yet reverse his tariffs, having previously postponed severe levies just hours after their enactment.

The situation presents Canada with a unique challenge. Prime Minister Mark Carney seemingly isn’t ready to call it quits on our largest trade partner; Canada recently cancelled its new digital services tax to appease Donald Trump after his outburst over the policy. Yet the US has proven a volatile partner, with the President citing questionable trade figures and unsubstantiated claims around fentanyl trade to justify his hardline approach. In a way, this has forced Canada to address its own short-comings - provinces have worked to slash their own trade barriers with one another, while Carney has promised to spur investment in the “nation-building” projects needed to expand trade prospects by cutting the regulatory red tape that has long held back the country’s oil and mineral markets. With AI’s insatiable demand for energy, the moves may yet position Canada as a key supplier in the space.

Still, with Trump’s August 1st deadline for trade deals fast approaching, and only a handful of discounted tariff trade deals so far signed, market risks remain elevated; the Budget Lab at Yale estimates the current tariff regime (as of July 13th) could shrink America’s economy by 0.5 per cent and Canada’s by quadruple that. Needless to say, we’ll be watching closely how the next few weeks and months play out.

As always, we thank you for your support and continued confidence in WDS.

Equities

Despite the ongoing headache of tariffs, Canadian stocks had a strong start to 2025, rising 8.6 per cent year-to-date as measured by the S&P/TSX Composite Index ($TSX). Add dividends into the mix, and the index saw a total return of 10.2 per cent. Materials led the pack, with mining companies (the majority of the sector) benefiting from rising prices for precious metals and other resources – the sector saw year-to-date total returns of 30.1 per cent. All other sectors saw returns of 4 per cent or higher save for health care, a tiny component of the index which contracted 6.1 per cent on a total return basis.

While returns were less attractive South of the border, the S&P 500 ($SPX) still managed to grow 5.5 per cent on a price return basis (6.2 per cent with dividends) despite the heavy April tariff-related sell-off. The return was much weaker in Canadian dollar terms however at just 0.8 per cent, reflecting the impact of tariffs on the US dollar. Results by sector were much more mixed than in Canada, with consumer discretionary and health care both contracting.

Returns were stronger outside of North America, with the MSCI EAFE Index ($MSEAFE) rising 19.9 per cent on a total return USD basis, albeit this figure falls to 13.8 per cent in Canadian dollars. Even Chinese stock indices managed to squeeze out a positive return in the face of the country’s trade war spectacle with the US, with most indices seeing low-single-digit growth.

Fixed Income and Interest Rates

Canada’s central bank policy rate saw two 25 basis point rate cuts in the first half of 2025, bringing the benchmark to 2.75 per cent in April. Rates are expected to come down further in the face of weakening economic activity – while annualized GDP growth of 2.2 per cent in the first quarter surprised to the upside, this was primarily due to the pull-forward of demand ahead of tariffs. For the next two quarters, GDP is expected to shrink as Canada deals with it’s largest drop (15.7 per cent) in exports to the US ever recorded outside the pandemic. Further rate cuts would help support the economy, which has struggled to attract investment amid tariff uncertainty, but could mean higher inflation and a weaker Loonie given the higher rates in the US.

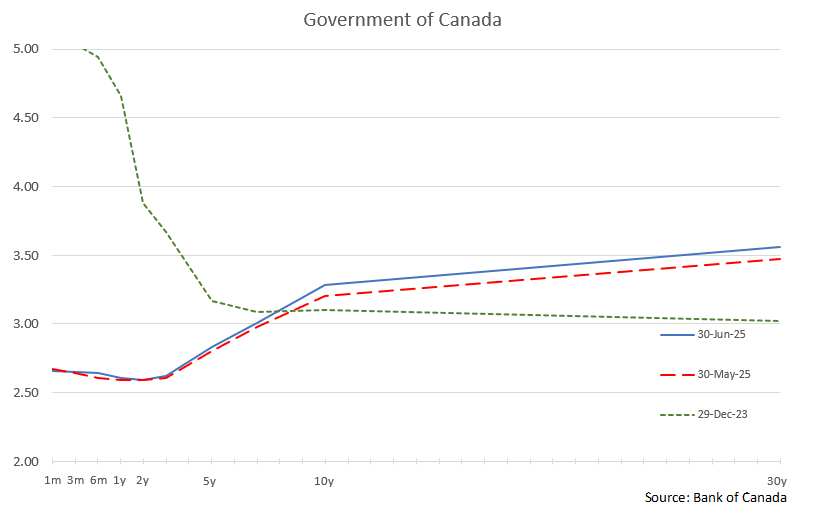

With short-term rates falling and long-term yields rising slightly, the Canadian yield curve has continued to normalize from its inverted structure. Bonds rose just 1.2 per cent amid higher longer-term yields.

In the US, the Federal Reserve has so far held off on reducing its benchmark rate from 4.25 to 4.50 per cent in 2025, citing the country’s volatile trade policy. At the same time, the US treasury market has experienced weaker demand in recent months, pushing 20- and 30-year treasury yields (benchmarks for longer-term loans) briefly above 5 per cent in May. The higher rates have begun to weigh on the economy; GDP contracted by 0.5 per cent in the first quarter as household spending growth reached its weakest level in two years.

Currencies

Headline inflation in Canada managed to cool in April from its 2.6 per cent level in February before climbing back towards its target, sitting at 1.9 per cent as of June. Interestingly, tariffs contributed to the initial dip; the sudden contraction in exports drove unemployment to 7 per cent in May, weakening wage growth and somewhat offsetting the direct price impact of tariffs. Still, core inflation (which strips out volatile components like food and energy) remains uncomfortably high, having reached 2.5 per cent in May, making it unlikely the Bank of Canada will cut rates much further in the near-term.

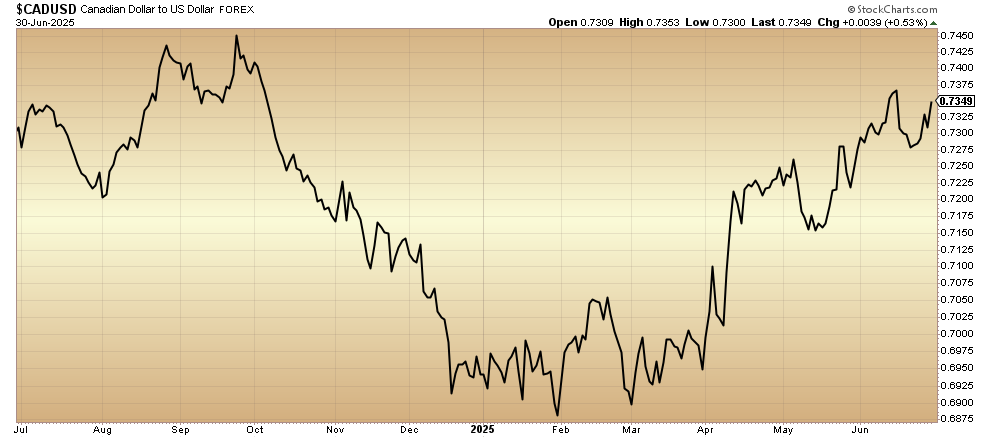

Despite the tariff headwinds, the Canadian dollar ($CDW) appreciated 5.5 per cent against the US dollar in the first half of 2025. The Loonie is now roughly where it was this time last year at 73.3 cents, mostly thanks to the weakening of the Greenback, which saw its 2024 gains eroded by Trump’s tariff regime. The country’s “Big Beautiful Bill” also played a role in the US dollar index’s 10 per cent decline year-to-date, with the widened deficit forecasts weakening demand for the country’s currency and bonds.

Commodities

Oil prices trended down through most of 2025 year-to-date, with the West Texas Intermediate ($WTIC) ending the first half of the year at $65.11 a barrel, down 9.2 per cent year-to-date. While prices spiked in June following the brief boiling over of tensions between Israel and Iran, the lower price ultimately reflects expectations of slower economic activity – the OECD recently revised its projected global GDP growth rate from 3.1 per cent to 2.9 per cent, a slowdown from the 3.3 growth achieved in 2024. Driving the revisions was uncertain trade policy, with the US having only announced a handful of trade deals ahead of its broad August 1st deadline.

Gold has meanwhile thrived in the turmoil, reaching a record high of $3,500 per troy ounce in April before settling lower, ending the year up 25.5 per cent at $3,277.30 per troy ounce. Gold tends to be viewed as a safe haven investment, rising in value as other asset categories lose their allure. Bitcoin, which some investors likewise view as a safe haven (albeit a more volatile one) saw its own price rise roughly 16 per cent over the same period. While the US administration hinted at moves to adopt the cryptocurrency, including through a rumoured “strategic bitcoin reserve,” the US has yet to make a meaningful commitment to the asset category.

This report is provided for your information. Conclusions and opinions given do not guarantee future events or performance. Facts and data provided are from sources we believe to be reliable, but we cannot guarantee they are complete or accurate. This report is not to be construed as an offer to sell or a solicitation of an offer to buy any securities. Before making an investment or adopting an investment strategy, each investor should review his investment objectives with their investment advisor. Watson Di Primio Steel (WDS) Investment Management Ltd. and individuals and companies who are related may, at any time, buy or sell securities that are hereby described in this report.