“The stock market is filled with individuals who know the price of everything, but the value of nothing.”

– Philip Fisher

S&P 500? More Like The S&P 5

The S&P 500 may soon want to drop a few digits from its name – five positions (Alphabet, Amazon, Meta, Microsoft and Nvidia) now make up over a quarter of the U.S. index and have driven nearly two-thirds (63.2 percent) of the index’s stellar 15.3 per cent jump year-to-date. Half of THIS contribution comes from Nvidia alone, which saw its price surge 156.5 per cent year-to-date, briefly surpassing Microsoft to become the most valuable publicly traded stock in the U.S. despite earning one-third of Microsoft’s revenue over the last twelve months. The driving factor of this run up, as you may know, is artificial intelligence – Nvidia supplies the precious processors needed to run these computing-intensive applications.

The excitement around being able to create 10 second clips from simple text prompts is masking a more mediocre market. The majority of S&P 500 constituents have seen returns of less than 4 per cent – a total of 200 constituents actually dropped in value in the first half of the year. It demonstrates the wide dispersion of results within the index, and points to a mixed story of how the rest of the year will fare.

On the one hand, the battle against inflation appears to be in its final inning. CPI figures in Canada and the U.S. have dropped meaningfully from their 2022 highs, and the Bank of Canada has already carried out its first rate cut of the year, with the cooling labour market seemingly paving the way for further cuts in the second half of the year. The cuts may yet offer some much-needed respite for heavily-indebted households and corporations, something that could perhaps push the broader stock market closer to the S&P top 5 if monetary policy eases and earnings beat dampened expectations.

On the other hand, inflation rates have not moved much over the past twelve months, with both Canada and the U.S. seeing the figure settle around three per cent. The price stickiness may force policymakers to further delay cuts, and with stock valuations already stretched on AI growth expectations, there is room for disappointment. The broader economy likewise faces a mix bag of forces, with slowing economic growth, international challenges (China’s real estate woes and conflicts in the Middle East and Ukraine, to name a few), and a rematch between Biden and Trump for the U.S. presidency all likely to influence how the rest of the year shakes out.

It remains to be seen whether AI will justify the dominance of the S&P 5, but if one thing is for certain, it is that 2024 is shaping up to be a turbulent year.

As always, we thank you for your support and continued confidence in WDS.

Equities

Canada’s stock market has so far seen middling performance in 2024, with the S&P/TSX Composite Index ($TSX) rising 4.4 per cent in the first six months. Inclusive of dividends, this figure increases to 6.1 per cent year-to-date. While comfortably-ahead of inflation, the average figure masks the wide dispersion of results seen by the Canadian sectors. Commodity-focused sectors performed the best, with materials and energy seeing price returns of 12.6 per cent and 11.3 per cent respectively, while communication services (made up entirely of telecom companies in Canada) fell a hefty 14.6 per cent. 5 of Canada’s 11 sector categories saw negative performance year-to-date.

The performance disparity is even more pronounced in the United States. Despite 200 constituents seeing negative performance year-to-date, the S&P 500 ($SPX) saw a remarkable 15.3 per cent total return for the first half of 2024 (19.6 per cent in Canadian dollars). The performance is thanks to a handful of larger-cap AI-adjacent positions who make up a significant share of the index; its unsurprising that information technology was the best-performing sector at 27.8 per cent.

Outside of North America, the MSCI EAFE Index ($MSEAFE) has seen a total year-to-date return of 5.8 per cent, with many European countries seeing disappointing consumer spending. Ahead of the U.S.’ own election, France and the U.K. have seen new parties brought to power in their own governments.

Fixed Income and Interest Rates

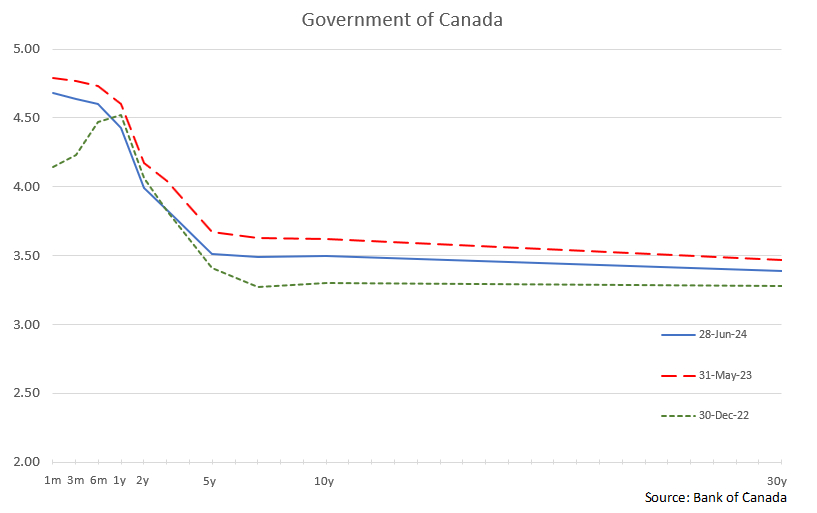

After two years of restrictive monetary policy, Canada became the first country of the G7 members to cut its policy rate, reducing the benchmark by 25-basis points to 4.75 per cent in June. The shift comes as inflation has managed to stay below 3 per cent (the high end of the central bank’s target range) for the first half of 2024 amid slowing economic activity; GDP growth for the first quarter came in below estimates at an annualized 1.7 per cent while unemployment continued its climb to 6.2 per cent. While central bank Governor Tiff Macklem has expressed caution in calling the battle over inflation won (the indicator ticked higher to an annualized 2.9 per cent in May), policymakers have indicated that its “reasonable to expect further cuts” if the economy continues to cool.

Despite the rate cut, the 10-year Canadian treasury bond yield actually rose for the first half of the year to 3.5 per cent. Longer-term bond yields take longer to adjust to rate decisions, and with yields still below that of shorter-term bonds, we are unlikely to see much movement for longer-term debts (e.g. mortgages) until the yield curve normalizes.

Meanwhile, the Federal Funds target range remains unchanged in the U.S. at 5.25 to 5.50 per cent. The U.S. economy has seen strong performance in spite of these restrictive rates, but with full-time employment having fallen for the fifth time in six months recently, things are cooling. Federal Reserve Chair Jerome Powell has commented that that the central bank will take its time amid a fundamentally-healthy economy; most economists expect one-to-two rate cuts by year-end.

Currencies

The Canadian dollar ($CDW) fell 3.4 per cent to $0.73 USD for the first half of 2024. The decline reflects the diverging interest rates between Canada and the United States as well as the country’s lagging productivity, with GDP per capita still below its pre-pandemic level thanks to a surging population. It is unclear whether Canada will move ahead with further rate cuts before our southern peer – while monetary easing could help close the country’s productivity gap with the U.S., it may expand its dollar gap.

It’s not just the loonie falling in value to the greenback –the U.S. dollar currently has the highest policy rate of the G7 and has seen its Dollar Index (representing its value against a basket of currencies) rise 4.4 per cent year-to-date. One member of the G7, Japan, has been particularly hard-hit by America’s high rates; the yen declined 12.3 per cent to its lowest level against the U.S. dollar since the 1980s due to the country’s near-zero policy rate. With interventions unable to keep the currency below 160 Yen/USD, more action is likely to come.

Commodities

Oil prices rose 13.8 per cent in the first half of 2024, with the West Texas Intermediate ($WTIC) ending June at $81.54 a barrel. While the run up in-part reflects concerns of a spillover from Israel’s conflict with Hamas, the higher price is largely a product of production cuts from OPEC, who recently extended its restrictive program well into 2025. The group faces lacklustre economic forecasts and lower demand from China, who itself is grappling with a banking and real estate crisis. We may yet see further action from the group to bolster prices – ~$80 remains below what many OPEC members require to balance their budgets.

Gold prices ($GOLD) pushed into unchartered territory this year, reaching a new all-time-high price of $2,450.05 USD/troy ounce in May before settling to $2,327.60 at the end of June, a year-to-date run up of 12.9 per cent. The higher price was in part thanks to central bank demand, which itself reached a record 290 tonnes in the first quarter led by China, Turkey and India. The higher price has, however, deterred some demand recently, with the People’s Bank of China recently halting its gold buying spree and keeping net additions flat for the second month straight in June.

This report is provided for your information. Conclusions and opinions given do not guarantee future events or performance. Facts and data provided are from sources we believe to be reliable, but we cannot guarantee they are complete or accurate. This report is not to be construed as an offer to sell or a solicitation of an offer to buy any securities. Before making an investment or adopting an investment strategy, each investor should review his investment objectives with their investment advisor. Watson Di Primio Steel (WDS) Investment Management Ltd. and individuals and companies who are related may, at any time, buy or sell securities that are hereby described in this report.